Nothing in this write-up, any prior write-ups, or content posted on the @Feathertopcap twitter account is financial advice. I am a private investor documenting my thought process publicly - mainly for review by others and feedback. I am not a financial advisor. Don’t take financial advice from strangers on the internet and always do your own research.

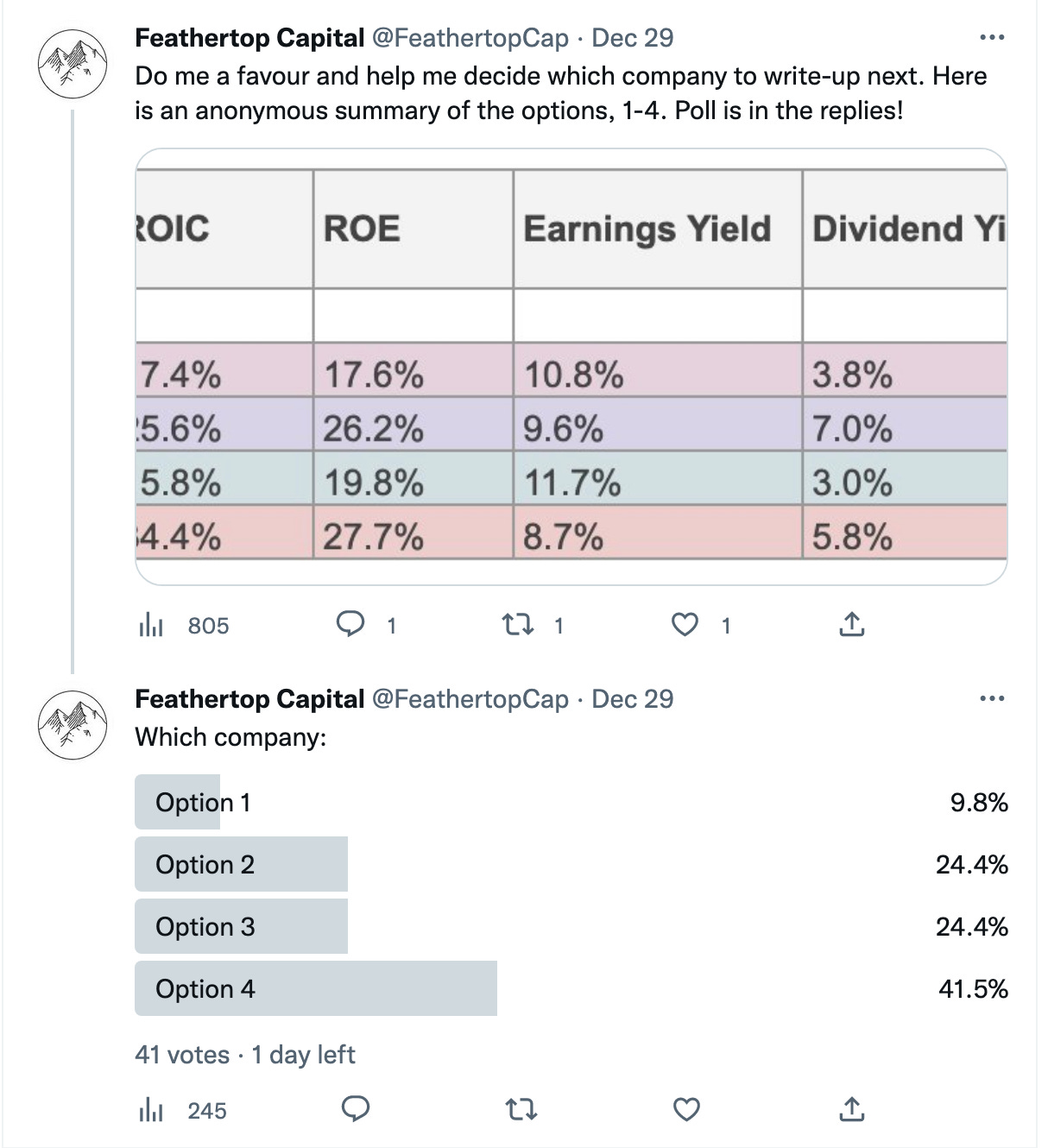

You might have seen my poll on Twitter asking which business in my watch-list you’d like me to look at next! I gave you a teaser of some metrics and then asked you to choose. Didn’t get a huge level of engagement, but thanks to those who picked one.

We’re looking at Option 4 today - which was United Guardian ($UG.NASDAQGM). As always, here is a snapshot of the company we’re dealing with. Take a look:

If you haven’t already, please consider subscribing to make sure you get any future writeups.

Overview:

Interesting little company with a long & basic history. Decent returns on capital and a possible buying opportunity given price drops.

Stock is down about -50% off its highs. Trades optically inexpensive and operates a low/no-growth cash generative chemical / beauty & pharmaceutical input business.

Sold off assuming because of:

Failed strategic review which was instituted early in the year (attempt to JV/Sell/etc was abandoned in June). I imagine the only reason this thing caught a bid at 17x EV/EBIT (over double todays multiple) was the anticipation of a sale.

Retirement of the long-serving CEO this year.

Strong USD hurts the competitiveness and margins of the company’s products. Competitors overseas undercut $UG prices. Making it harder is that a large part of $UG’s end market is overseas. Management suggested this may force $UG to cut prices (see below and Attachment 2)

Margin compression due to sales of lower margin products relative to higher margin products.

Bond portfolio may have been whacked and not yet showing on the books (see below and Attachment 1).

Originally called “United International Research”, the company was founded in 1942 by Dr. Alfred Globus. It merged with Guardian Chemical Corp in 1982. Dr. Globus died in 2009 and was succeeded by his nephew Ken, who retired as CEO this year. The new CEO, Beatrix, has no prior CEO or director experience. Ken is staying on in a consulting capacity, presumably to help the new CEO get into the role. No directors (apart from Ken) own shares.

Products:

$UG has over the last 10 years sold two main classes of products:

Lubrajel (78% of sales in 2010, now 60%), which is mainly used in skincare/cosmetic products to form the base as a moisturiser, viscosity modifier or base for makeup/skin cream → some variations use preservatives / parabens and some don't, there are variations that are compliant with natural/organic cosmetic product requirements. There are also variations that are used as medical lubricants for urinary catheters, enema tips, and oral care. These medical uses are 14% of gross sales, and shrinking. A large customer loss reduced this from 19% in 2020. So most are cosmetic base inputs for other drug/beauty companies.

Renacidin Irrigation (17% of sales in 2010, 34% now), this is a prescription drug to prevent/dissolve calcifications in urethral catheters and bladder. Gross sales made up 34% of total gross sales, down 6% on 2020. A related product, Clorpactin, is an antimicrobial product used to treat UTIs, but can be used in surgery for localised infections in the ENT region. This is 5% of gross sales and grew in 2021 but is minor overall.

Oddly: the business summary in the latest 10k has total gross sales in 2021 exceeding 100%? How.. anyway..

Company markets:

Cosmetic ingredients: sold through a marketing partner/reseller “Ex Works” from NY state. These are sold to cosmetic/personal care manufacturers to incorporate into products → not refundable in any circumstances.

Pharmaceuticals / medical lubricants: sold to full-line drug wholesalers who supply to pharmacies, doctors, hospitals → these are returnable if medical standards aren’t met by $UG.

Specialty industrial products → on case-by-case? Presumably small part of their business.

Brand / R&D

$UG has a single strong-brand product (Lubrajel) with higher margins than their other products. While this is the best seller, its % of total sales is shrinking. Overall, $UG has very high sales concentration in $ASH.NYSE with a long history between the two companies. More on this below.

Its R&D focuses on development of new and unique cosmetic ingredients. It tries to protect its inventions through trade secrets rather than patents. Most of the ongoing R&D opportunities are variations and derivatives of Lubrajel. The Company expects the European market “to remain very competitive” based on the continuing competition from lower-cost competitors, and for that reason it is concentrating its R&D efforts on developing “new and unique products that these other companies do not have”. 🤔

Products are marketed through collaborative agreements with larger companies.

The Company does not make sales on consignment, and payment by customers is not contingent on the successful on-sale of the product. ✅

Company outsources its marketing globally to five partners. Its largest is ASI (Ashland Specialty Ingredients) which is a subsidiary of Ashland ($ASH.NYSE). It has jointly developed some variations of Lubrajel with $ASH. Ashland’s predecessor, ISP, entered into an exclusive marketing/distribution agreement for cosmetic ingredient products with $UG in 1996, which is ongoing. It is in place until 1 January 2024 and will auto-renew, unless terminated 60+ days’ prior.

It has no patents that are live. The ~32 patent portfolio lapsed over the years. In 2010 patents appeared to be a priority, but now not so much. The company now uses trade secrets to preserve formulations. It has trademarks for the names Lubrajel, Renacidin and Clorpactin.

Geographic explanation

The company sells mainly in the US but has a large international exposure through its own customers, mainly ASI.

A stronger dollar compared with foreign currencies might make UG’s products less competitive in foreign markets “sometimes requiring the UG to adjust its prices in order to be more competitive”. 🚨

Other

Inputs

As for inputs, $UG says that the principal raw materials used by the Company consist of common industrial organic and inorganic chemicals & most of these are available in ample supply from numerous sources. The Company has six major raw material vendors that together accounted for approximately 94% of the raw material purchases by the Company in 2021.

Competition

Its Lubrajel line of products is well known globally and has a long-standing reputation for high quality

Market is “highly competitive” and during 2021 the Company experienced a high level of competition for its cosmetic ingredients both in the U.S. and in foreign markets, not helped by FOREX movements

“it may sometimes be necessary for the Company to lower its prices, and reduce its profit margins” 🚨

Assets

Over half of the company’s assets are in equity and fixed income mutual funds. Of that, the vast majority of marketable securities are fixed income mutual funds. Only 10% is equity / other mutual funds. This has been a shocking year for fixed income mutual funds. 🚨

The company has not recorded an impairment charge in 2021 or 2020 to those values since “management believes, based on its evaluation of the circumstances, that the decline in fair value below the cost of certain of the Company’s marketable securities is temporary” 🚨

The company has been selling its mutual funds over 2020 and 2021. It made a net gain on those sales in 2020 of nearly $300k and a net loss of $23k in 2021. Realised gains were $415k and $111k respectively.

Inventories have increased 62% this year

The Company owns a 50,000 square foot facility on a 2.7-acre parcel at 230 Marcus Boulevard, Hauppage NY. 30,000 feet is manufacturing space, 15,000 sq feet is warehousing, 5,000 is office/lab space. The 2.7 acres is fully developed. It is unencumbered. 🤔 It is carried on the balance sheet as of September ‘22 at $69,000. RE listing sites suggest a market value closer to $3,000,000? ✅ Would increase book value by about 20-25% roughly.. But still not screaming cheap on P/B.

Working capital

Cash from operations is flat over the last 10 years.

The Company has no material commitments for future capital expenditures and no material cash requirements of immediate concern.

Management

Ken Globus joined the board in 1982. He is 70. The founder (Alfred) was Ken’s uncle.

The rest of the board are in their 70s/80s. Ken resigned in mid 2022 from the board and was replaced in late 2022. Ken, according to the last 10K, owns ~28% of the company.

The rest of the management team have negligible holdings in the company.

24 employees. 16 are in research. Rest in exec/maintenance/office support.

Failed exploration of ‘strategic opportunities’ which was launched in early 2022. Looked for joint ventures, strategic partnerships or alliances, an outright sale, or other transactions. They used Capstone Partners. vijayb@capstonepartners.com & pjanson@capstonepartners.com. Pulled the pin in June, and announced the retirement of the CEO, Ken. I considered reaching out to see why the strategic options were not viable but doubt they’d share such info. Ken will stay on the board and act as Chairman. He will remain in the business as a consultant. Beatrix Blanco, an external hire, will replace him. Beatrix has not acted as a President or CEO before 🚨 (prior she was in sales/marketing in cosmetics/healthcare). Interestingly, her LinkedIn in says she worked at ISP ($UG’s primary reseller) from 1998 to 2003. 🤔 Note that ISP was bought by Ashland much later, in 2011, so it's unlikely her connections are as strong as they were.

In November 2022 Beatrix declared a 0.31c dividend per share despite the share price having declined -54% and trading at about 8x EV/EBIT instead of instituting a potential buyback, suggesting either poor capital allocation or an expectation that the company’s stock price will decline further 🚨

Beatrix has suggested that based on $UG’s ‘new marketing efforts’, as well as ‘strong product development’, she is optimistic that $UG will have a ‘promising’ 2023.

Actionable insights:

Could make a good asset play given the marketable securities and property assets but even after a -50% drawdown and if we count the property on which the factory sits as worth $3m instead of $66k as carried, it is still >3x book value today. We also haven’t seen the bond portfolio value adjust.

While a trade sale was abandoned in June and a new CEO appointed (albeit with zero prior CEO experience) she previously worked at ISP (subsequently bought by Ashland $ASH nearly a decade later). $ASH is the most sensible home for this business given sales concentration and long history between the two businesses. Ashland is nearly a $6b company with >$500m on the balance sheet in cash. $UG is tiny with a market cap of $47m. With that said, it probably isn’t enough to go off for a buyout strategy at these prices and with news as is. If it got cheaper, the R/R might make sense (or if we got certainty a deal was on foot, which we do not).

Will wait to see what happens in the leadup to 23 March 2023 (next earnings release, with latest 10K) and note the price movements if any.

Conservative DCF (workings below) suggests 33% upside with the status quo remaining the same (excluding dividends). Not amazing annualised but it is something. Also bold to assume margins do not compress given the warning signs.

There are risks, several in fact. Poor CEO performance seems likely but time will tell. Margin compression is possible and flagged up in the 10K. Lack of catalyst (which is speculative at this stage, at best) would mean the stock is likely to go nowhere an underperform.

A pass for me, for now. Will wait and see what price does, and what comes out in the next 10K.

5 Year DCF:

Last but not least, follow me on Twitter to vote in any future polls for upcoming write-ups. You can find me on the bird-app by clicking below:

Attachment 1:

Attachment 2:

No growth or increased value creation