Nekkar ASA (DB:0TT)

A market leader in an oligopoly, trading at at an EV/EBIT of 6.6x, with 50%+ gross margins, 50%+ ROIC on its main business arm, with two hidden moonshot projects.

Nekkar ASA

NKR.OB / DB:0TT

Market cap: 123m (USD)

Sector: Industrial

Shares outstanding: 106m

4Y Price return: 467%

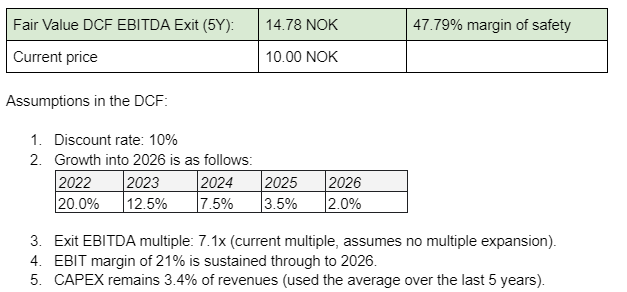

Nekkar, formerly TTS Group, is a small industrial business based in Norway that operates in a concentrated oligopoly. Nekkar is the largest player in the space and claims to hold an eye watering 75% market share of ‘shiplift’ installations globally through its flagship product, Synrolift™. It has a controlling stake in a hidden software subsidiary, and has 100% ownership of two potential moonshot products in development stages (one in aquaculture, the other wind energy) that come with a company priced like a true value stock. It trades at an EV/EBIT of 6.6x, a P/E of 8.7x, while boasting gross margins of 47% and high (~45%) returns on capital. It has no debt, no preferred stock, options or convertibles. My DCF calculation suggests an approximate 50% margin of safety (with a bearish discount rate and growth assumptions, with no multiple re-rate).

While revenue is linked to lumpy, large bespoke construction contracts, half of the company’s construction revenue is paid for up-front by customers, reducing customer risk and evening out revenues. In addition, it has an order backlock that extends out for years, de-risking the investment significantly. Moats that I observe are: 1) barriers to entry 2) proprietary technology/designs 3) pricing power through assurance benefits to customers. The firm has a mild cost advantage vs competitors (by subcontracting aspects of its construction offering) but a cost advantage is not as strong a moat as the other aspects.

Pros:

Nekkar operates in an industry with high barriers to entry due to (a) the requirement for reliability and brand power to open doors and (b) large CAPEX and R&D investments required to develop systems and expertise in the space. Nekkar enjoys a vast majority market share already. The market is comprised of regional monopolies across the globe.

Nekkar has proprietary advantages through patented Shiplift technology used by the vast majority of shipyards globally.

Good margins, high returns on capital, sensible cost management, legacy low margin business has been sold off so long term averages don’t accurately reflect future returns.

Macro shipping tailwinds, and company specific tailwinds (push to recurring service revenue).

Hidden moonshots within the business, including two very interesting forms of technology that come with a bargain priced company.

The company holds significant bank deposits (nearly half of its assets), making up pre-paid contracts for a big backlog of work. It has little to no debt. As a result, inflation and increased rates stand to benefit the company in that regard. Where inflation poses a risk is in increased future contract costs combined with contract prices being agreed months or years in advance.

Risks:

Nekkar services corporate customers, on large projects where those customers are focussed on costs. Work is won through a bid/tender process. This is not a good price environment as it motivates customers to squeeze providers on price, and therefore margin. This is partially offset by Nekkar constructing offshore (where their main competitors construct onshore) as well as the lack of competition.

Nekkar competes against a company based out of the US which is run by the son of the creator of their patented technology (read on to hear about how…).

Investor sentiment was softened due to an arbitration in relation to M&A it conducted (now settled).

Management is in a bit of limbo (the company has been run by an interim CEO for 12 months).

Under IFRS, R&D is capitalised and not expensed - so margins may appear better than they really are.

Not being vertically integrated, Nekkar do not have as much control over the construction process - being a potential risk where brand power and reliability is extremely important for the business.

The business had five customers that each accounted for more than 10% of revenue, creating some customer risk. This is offset by the prepayment element for work being done and is a byproduct of the industry and the large costs of projects.

Why does the opportunity exist? The company has just come out of an adverse arbitration/settlement regarding the sale of its legacy cargo assets to a firm called McGregor. The company accurately provisioned for the down-adjusted price payable on the sale contract (was due to liabilities accrued through the now sold Chinese assets). Having sold its cargo/crane business (along with the legacy brand, ‘TTS’) the company is now deriving ~90% of its revenues through the Shiplift segment of the business, a rare oligopoly. The ex-CEO also resigned in late 2020 (on ‘good’ terms) but I presume due to the botched management of the McGregor transaction and the transition of the company’s focus away from cargo and toward shiplifts and the ‘moonshots’, though this certainly doesn’t come across in official messaging - just my inference/best guess. These factors may also explain the valuation gap, in addition to the fact that it is extremely obscure/small - it is only covered by one analyst with a price target around the current price.

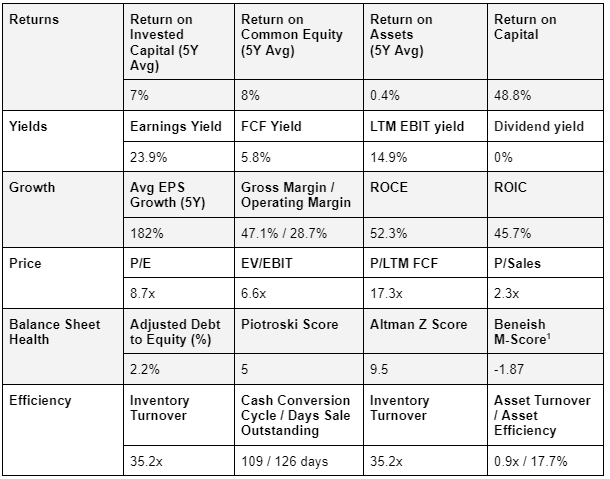

Returns and key metrics

Valuation

Insider buying: Skeie Kappa Invest AS, a company controlled directly by Trym Skeie (majority shareholder and the Chairman of the Board) on 28th January 2021 purchased 250 000 shares in Nekkar ASA, at NOK 6.9 per share. On 27 October 2021, Mette Harv, of EVP New Business, sold 40,000 shares at an average price of NOK 4,98 per share. Following this transaction, Mette Harv holds 189,958 shares in Nekkar ASA.

Business overview

The Company has 3 main business arms, one is the crown jewel revenue generator, and the other two are our ‘Moonshots’.

“Syncrolift” shiplift solutions

“Starfish” open-ocean fish cage

“Skywalker” wind turbine installation solution

The focus of this writeup is going to be Syncrolift. Starfish and Skywalker are all upside, hence their moonshot status. Worth reading into if you’re interested in the tech. “Starfish” is a fish-farming net and software solution that could significantly reduce OPEX for the fish farming industry, while simultaneously improve fish welfare - it captures 90% of biological waste, avoids problems with salmon lice, and has reduced instances of escape. “Skywalker” is a prototype wind turbine installation system, allowing wind farms to be built (onshore and offshore) 82% faster, with less CAPEX (about 10% of the previously required number of trucks and cranes) and allows windfarms to be build in higher density (reduction of square metrage required by 62%). Both products are in development/pilot testing stages.

I’m not digging into the digital solutions arm of Nekkar called “Intellilift”, which provides software services to the three main business units (and other businesses). It is a 51% owned subsidiary. The main shareholder of Nekkar also holds a large stake of the digital solutions business. Intellilift provides software platforms for collection, monitoring and control of data for the aquaculture industry and a variety of offshore energy industries (oil and gas + wind).

Nekkar has 63 employees, is HQ’d in Kristiansand Norway and is listed on the Oslo Stock Exchange (with an filing on the DB). It has subsidiaries in Norway, the USA and Singapore. It has a sales/service office in Dubai. Management state that they are the “global market leader for shiplifts and transfer systems offered to repair and new-building yards” with a 75% market share for the installation of shiplift systems globally.

A shiplift is a large elevator platform that raises ships out of water for dry-docking ashore and lowers it back into water after completion of work. It is also used to launch new ships from shipyards. Common ship transfer systems have electro-hydraulic trolleys, which are designed to transfer ships from shiplifts to dry berths on land. Shiplifts & transfer systems fall into three main categories: winched, hydraulic lift docks & floating dock lifts.

The crown jewel revenue generator, Synrolift, was purchased off Rolls Royce in 2015. Rolls Royce originally purchased the technology off the founder/inventor. The asset deal gave Syncrolift ASA (then TTS Handling Systems AS) an exclusive and unlimited right to conduct future business based on Syncrolift™ products and relevant intellectual properties and included takeover of drawings of 250 shiplifts, patents and the brand (Syncrolift™). Nekkar retains these rights even after the brand change (more on this below under the Macgregor transaction).

Back to the business. The vast majority of the company’s revenue is derived from its Shipyard solutions / Syncrolift service in the South/South-East Asian regions and Europe. It faces competition in the US from two main competitors.

The Company uses hedging instruments on a 24-month period for firm contracts for sales in currencies other than NOK to hedge against currency risk.

Nekkar doesn’t build the shiplifts themselves, but are instead doing the design and drawings of new lifts which are usually are highly customised. The assembly of new lifts is sub-contracted to third parties, often in Asia, which is the largest market for shipyards and also low-cost. Long term construction contracts have a typical duration of 18-48 months (from the date contracts are signed to the date projects are closed). These projects are engineer-to-order projects, which deliver highly customized turnkey systems. As noted above, the vast majority of work is paid for upfront due to the bespoke nature of the products.

The sting in the tail is that while the Company states 90% of shiplift systems globally are Syncrolift™ installations, Nekkar only serve ~15% of its total combined installed base with services and aftermarket part provision. A lot of this work is being done by competitors. The interim CEO says Rolls Royce, and to a lesser extent subsequent Nekkar leadership, were focussed not on securing the services business and ceded it to competitors. New management aim to change this. The Company aims to secure its installation clients with decades-long service contracts while offering unique after-sale services to lure them in. For example, for a Navy client in south-east asia, after a life extension project was completed (August 2021), Syncrolift Singapore entered into a 20-year service contract for the same project. This aspect of increased service revenue is one of two prospects for enhanced earnings.

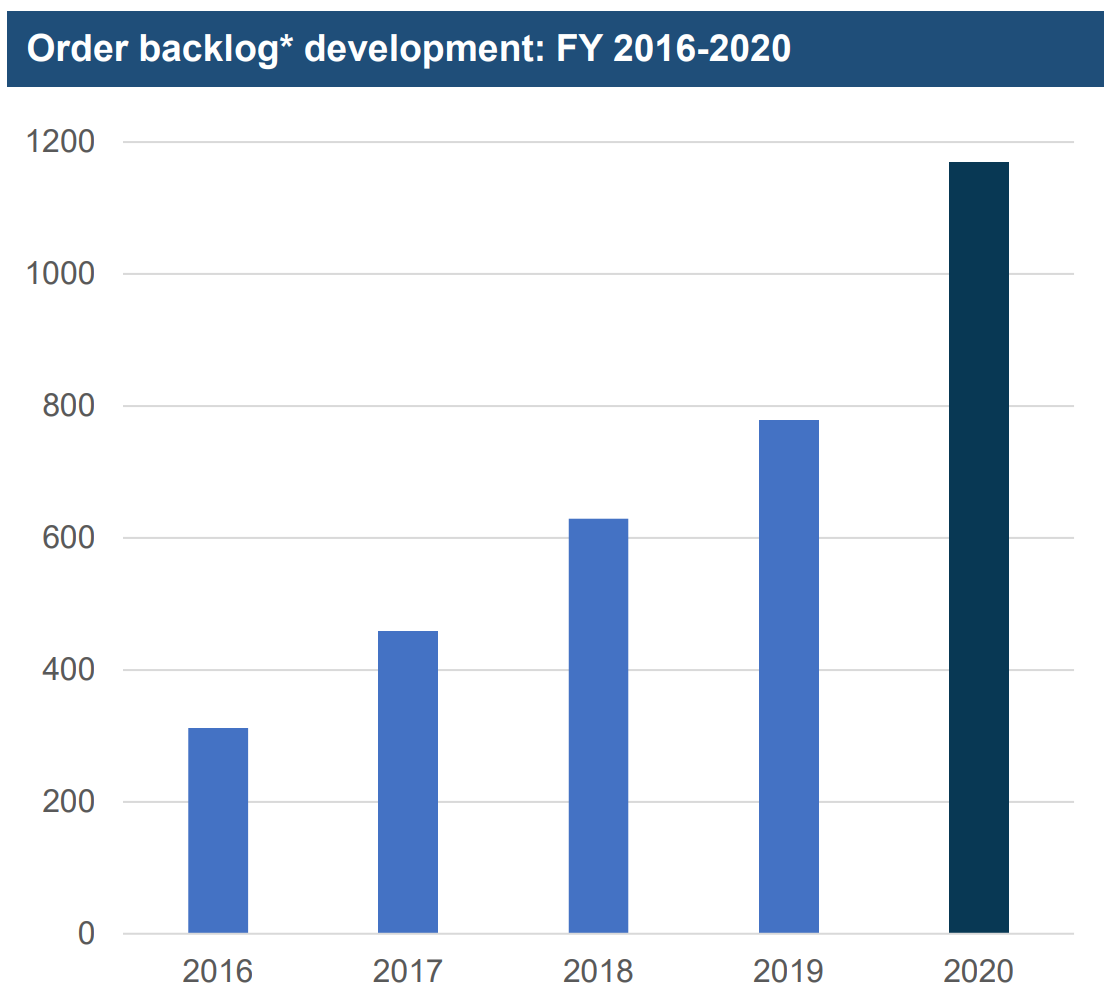

The second is that Nekkar have an order backlog of NOK 1 billion, which is its highest backlog figure yet. This will provide the company with revenue for years to come, allowing the sales team to focus on securing recurring revenues, while also allowing R&D to continue on the moonshots. There are still tailwinds for the global shipping industry - both in the number of ships floating around, but also the need to upgrade shiplifts and shipyards to cater for more drydock space, and heavier duty lift systems to cater for larger vessels. Ships (military and commercial) are growing in number and weight each year. Sea transport is cheap and more energy efficient as compared to other modes of transport. Currently, seaborne trade accounts for over 90% of the global overseas trade. Syncrolift systems allow shipyards to remain competitive and keep ships in the ocean for longer.

Sale of Macgregor, turnaround

This transaction is worth mentioning only due to its relevance to the “why now” aspect of the thesis. The company’s history from 1999 through to 2015 (particularly the early 00’s) saw the company create numerous JVs with Chinese entities to engrain itself into the Chinese shipbuilding industry with a focus on cargo and cranes (which have been sold off). These JVs (many were loss making) have been sold off to Cargotec/Macgregor in 2019. Nekkar no longer has its legacy offshore assets business. Those assets were the company’s cranes and winches, internal and external covers and doors, handling equipment for offshore construction and support vessels for drill ships, rigs, accommodation and service units and heavy lift and utility ships, as well as the ‘TTS’ brand. The old CEO is out, and as noted above, the Company’s renewed focus is on taking the revenue from its oligopoly crown jewel and using it to reinvest into that business, plus two in-house moonshot products, while also taking back some of the service revenue for its installed bases globally. Who better to service the shiplifts than the manufacturer? Arguably the progeny of the inventor…

Competitors

What I really like about this business structure is that geographic expansion is going to be extremely difficult for Nekkar’s competitors, and the marketplace is composed of regional monopolies. Pearlson dominates the Americas, Nekkar dominates Europe and Asia, and Bardex is growing a niche in France. All parties are clearly able to extract value from the market, but there is little room for new competitors to appear.

We have to talk about Pearlson.

In 1958, the father of the founder of Pearlson invented Syncrolift. The founder sold his company (including the Syncrolift tech) to Northern Engineering Industries (NEI), a British engineering group that in 1989 became part of Rolls-Royce, plc. In the early 90s, the inventor and his son created a shipyard consulting firm, specialising in drydocking, named Pearlson & Pearlson. In 2008, Rolls Royce closed their Miami HQ for shiplifting, the inventor’s son ‘rounded up the old team’ before Rolls Royce got involved and created a shiplift company being very mindful not to mention Syncrolift. In 2015 Rolls Royce sold its Syncrolift brand and technology to Nekkar ASA (then TTS Group), with non-competes for Rolls Royce, but obviously Pearlson were unaffected. Pearlson occupy this site: https://shiplift.com/. They claim to possess “the most experienced team of shiplift engineers and technical support specialists in the world” and claim to be the “premier choice for shipyards all around the world”. They are careful not to pass off Syncrolift as their own.

A more fulsome list is set out below, but unfortunately none are public companies which make financial comps hard.

Bardex Corporation

Bosch Rexroth AG

Damen Shipyards Group

GANTREX

Larsen & Toubro Limited (LSE:LTOD)

Maschinenfabrik Bröhl GmbH

Pearlson Shiplift Corporation

Ra In Ho Co. Ltd.

Rolls-Royce Holdings PLC

Royal HaskoningDHV

TPK Systems Pte Ltd

Moat(s)

Barriers to entry are high.

Nekkar has a perpetual technological advantage which has proven resilient for over half a decade.

Clear assurance benefits for the customer - not hard to imagine how a failed shiplift could catastrophically damage a shipyard’s image, reputation and financial stability. There are subtle benefits too. A more efficient yard means that shipyards can service more ships, process more cargo, and lower their OPEX.

Financial Health

As a general rule, I try to avoid indebted or troubled companies. It might be that I worked in restructuring and insolvency and have a slant toward pessimism. Its more likely that its too hard for me.

Take the comps column with a grain of salt, due to the lack of viable publically traded companies in the shiplift space.

Management & Insiders

75% of the Company is held by the top 20 shareholders below:

The Chairman (a VC and engineer by trade) has been chair since 2009 and holds about 30% of the company (see notes under the table). He is Skeie Technology.

Rasmussengruppen, the second largest shareholder, is an investment firm that specialises in offshore work and shipping. Gisle Rike sits on the board to represent them and has done so since 2015. His director fee is paid to Rasmussengruppen, not him personally. Bit disappointing.

Ingunn Svegården and Marit Solberg are new directors, both joined in 2019. Both have backgrounds in biotech/chemistry. Ingunn is focussed more on VC work and Marit has a history with the seafood industry and aquaculture. Their work would be focussed on Starfish where Nekkar’s engineers can apply their skills toward Skywalker.

Preben Liltved was appointed interim CEO of Nekkar ASA with effect from 1 October 2020 after the prior CEO left on “good terms”. Preben remains interim CEO - it's been over a year since he took the helm. I emailed him a few questions and he replied overnight - very candid and to the point. Among other things, he confirmed he will remain interim CEO for now. Unfortunately, board remuneration is not linked to the company’s performance or metrics that I like, such as return on capital. Trym Skeie is paid very well. Notably the interim CEO is being paid under half of what the previous CEO was being paid. The interim CEO also holds less than 0.01% of the company. See holdings and pay below:

Capital allocation

Post divestment of legacy assets, the company is generating more NOPAT than it has historically. It is increasing reinvestment and R&D spend:

In the past, the Company had taken an M&A warpath:

As you can see, the M&A warpath was extensive. Syncrolift (2015) was the Company’s best move. In the end, Goodwill was wiped out after the divestment process in 2019.

Sensibly the company also reduced its debt significantly as part of the divestment and demerger.

As for strategy going forward, management has said that the “prevailing business strategy is planned to be funded with cash flow from operations.” Their message around risk and return is good: “Nekkar aims to give shareholders a competitive long-term return that reflects the risk inherent in the company’s operations. Based on Nekkar’s capital structure and growth strategy, the shareholders’ return should be realized mainly through an increase in the value of their shares.”

As I don’t have access to the Oslo Stock Exchange, I have taken a position in the firm’s cross listing DB:0TT at a cost base of €0.94.

An interesting idea; I read up on this to see what I missed. Where did you find the stat that Syncrolift serves a mere 15% of its installed base with services?