Dow Schofield Watts ($DSW)

Capital light, scalable, low churn, optically cheap, recurring revenues, recession resistant

Disclaimer

Nothing in this write-up, any prior write-ups, or content posted on the @Feathertopcap twitter account is financial advice. I am a private investor documenting my thought process publicly - mainly for review by others and feedback. I am not a financial advisor. Don’t take financial advice from strangers on the internet and always do your own research. Assume I’m holding shares. Be careful with this one - its a very illiquid, small company on the AIM in the UK. Always DYODD.

Click here for the write-up!

As always, I’ve included the summary points below so you can decide whether or not you want to read the full writeup (link above). Before you get started, I need to give some kudos to Tristan, who alerted me to the existence of DSW, due to my interest in Keystone Law ($KEYS) which is a similar model (you can find my writeup for Keystone here if you’re interested).

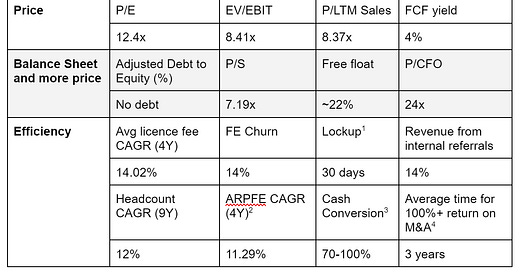

Tristan has a substack, but you’re probably better off following him on Twitter here. He has his own writeup which you should check out as well! Anyway, onto some key metrics for this business:

Dow Schofield Watts is an accounting firm in the United Kingdom. It has a market cap of ~£28m and was recently IPO’d. It operates a platform model, and earns its profits through a licence structure (rather than taking equity ownership).

Why does the opportunity exist?

Absolutely tiny market cap and only one analyst covers it (same guys who floated them).

Listed on the AIM, hard to access for a lot of investors.

Recent IPO, company not showing proper data on many screeners / data aggregators yet.

IPO costs and one-off SBC as part of IPO make the company look EPS negative.

Professional service firm roll-ups have a bad reputation, but this company is not a rollup - its emulating a highly successful licence model in the UK.

Why is it compelling?

Predictable cost base with low operational gearing. Capital light, scalable platform model with low risk on expenses front if network revenue drops.

Four different levers for growth (organic hires, acquiring licence fees / breakouts, increase in licence fees naturally and increase in operating margin by increasing revenue/FTE)

Capital return policy for shareholders (mgmt think 70% payout ratio is maintainable)

Attractive valuation, debt free, cash generative

Recurring revenue in the sense that employees are heavily incentivised to bill more and on a continuing basis to support themselves (due to lack of a fixed salary)

Inflation resistant vs other firms, as DSW FEs are incentivised to increase their charge-out rates quickly (directly linked to their remuneration)

Recession resistant as (a) there’s no risk to margin compression if network revenues drop & (b) DSW is growing either cycle agnostic or counter-cyclical practice groups (e.g. tax, insolvency)

DSW has a 30 day lockup vs other listed accounting firms all being >90 days.

Low FE churn at 14%. Recruiting becoming easier after IPO, even in tough labour market. Signals brand strength and good prospects for FE growth.

Catalysts:

Next financial release will show large profits once again after one-off expenses cease.

Continued high cash generation and inflation/recession resistant performance.

Multiple re-rate to match peers (e.g. Keystone).

More licencee acquisitions through recruiting & more breakouts.

Better fundamental data will feed into screeners and put the company on the radar of larger investors. Potential LSE uplisting if size permits. Etc..

What are the risks?

Failure to acquire synergistic businesses with excess capital, overpaying in licencee integration (i.e. taking too low licence fees for new licensees - although 22% will be the targeted minimum going forward), or just bad capital allocation generally…

Investments in early stage licensees are impaired / licensee growth is stunted as they loan capital + front initial partner drawings (however they are moving away from this strategy, and investment payback period is only ~3 years)

60-70% revenue exposure to SME M&A spells concentration risk, though that concentration risk was reduced in the most recent FY so thats good.

Concentration risk in a small number of overperforming licensees may increase if (a) internal licensee growth is promoted, rather than (b) a higher number of FE headcount across more licensees → but the company has brought on internal recruiting staff and is aiming to go heavy on recruiting to presumably to address this. Apart from one licencee, the no other licensees contribute more than 10% of revenues to the network.

Lower switching costs / stickiness vs. comps like Keystone, since DSW back-end support is more limited. Churn is still super low (14% for FEs) and all FEs have resulted in a net-cash gain - i.e. even departing FEs have not caused losses to DSW.

Some selected quotes:

On pricing power:

“profit share income has increased 125% YoY and FEs are busier and improving charge out rates as the year continues”

Nicole Burstow, CFO (Sep 2022, Investor Presentation)

On quality control:

“The weakness of all professional services models are the weaknesses of the weakest partner… we address this in different ways”

James Dow (Sep 2022, Investor Presentation)

On comparing metrics to their competitors, the Big-4:

“On a revenue to fee earner basis (R/FE), we are in-line with the Big 4, showing a large amount of respect for us within the market.”

Nicole Burstow, CFO (Sep 2022, Investor Presentation)

Anyway, check out the full writeup here and let me know what you think.

Hey, great work. Have you interviewed any of the Fee Earners to see what they say about DSW? I interviewed James and emailed with Nicole but haven't spoken with a FE yet. Maybe you have?