Hello reader.

I have something exciting to share with you! I’m in the news.

You know when you see that statistic, like “80% of retail investors fail to beat the market” or whatever? Yeah, well, (I hate to gloat) but thats me! The gall I have to put a ‘subscribe request’ above this statement is truly something isn’t it?

Turning into a statistic was not a goal I set for myself this year. But alas, its time to kick back, relax (??), and suffer with me as we go through the calamity that was 2022 and watch it happen. I did some real number crunching on this one. In hindsight, I reckon I thought that if I came up with enough numbers, ratios, metrics… something would look good. Something would make sense. And then I could look past the number that really mattered. -11.92%. Ouch.

Let us have a look at the state of things.

Portfolio at year end

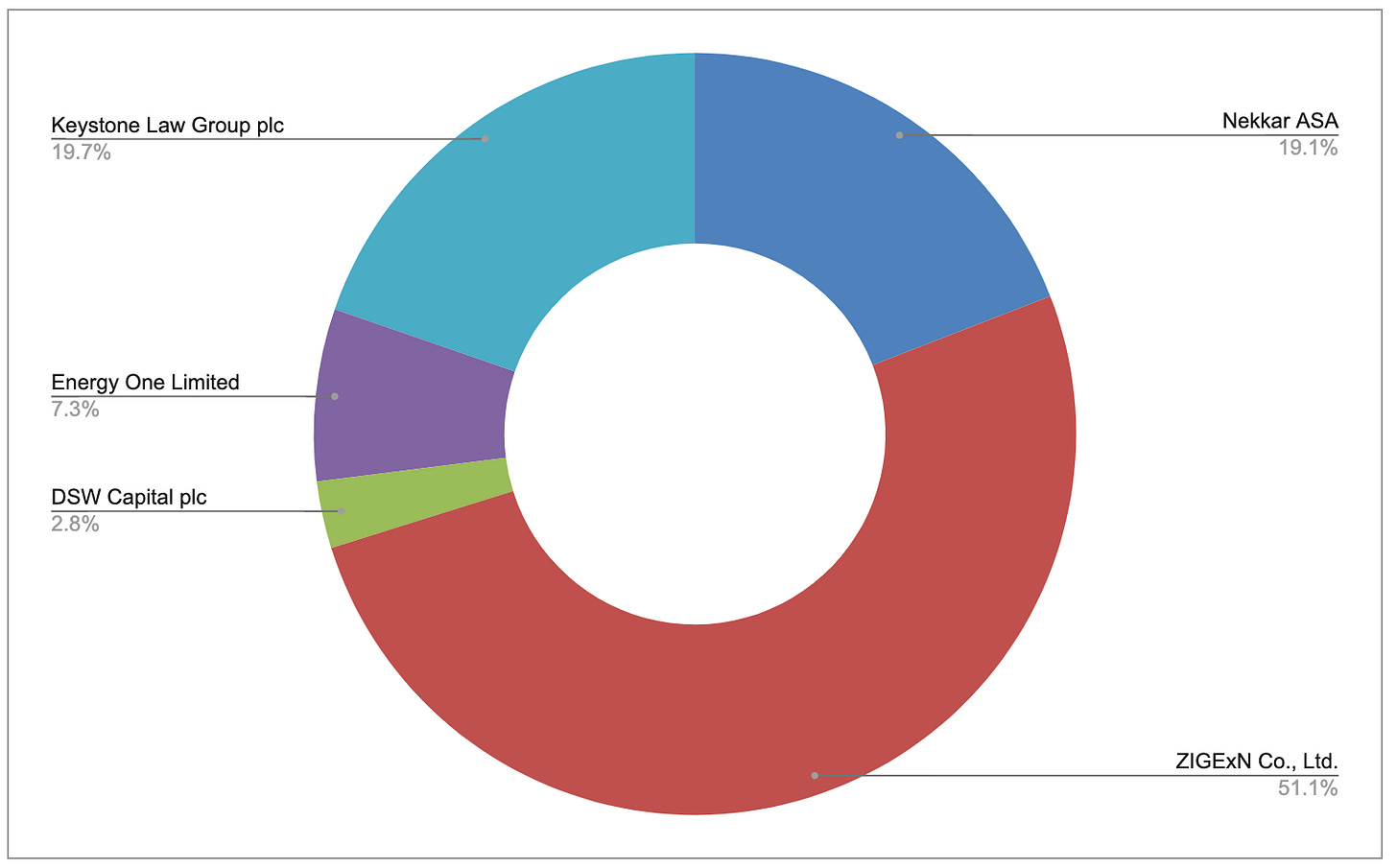

Here is my portfolio by position size.

And this is where the revenue in my portfolio comes from. Just like birds and the bees, but somehow more terrifying. Look at that concentration!

Note the disparity in position size vs revenue contribution for $DSW!

Performance

Love the look of this chart. Just not what it means.

Mis-en-place

Alright, here are the numbers of the portfolio as a cohort.

Overall: Portfolio feels very weird and has hurt to look at most months (performance wise) but after stepping back, aggregating things, and blurring my eyes a little - it looks to be in pretty decent shape, quantitatively at least.

Feels like I’m describing myself in the mirror.

Some broad numeric observations for you: volatility / beta are both low across the board. Energy One and DSW are extremely tightly held with very low share turnover, and move erratically but infrequently (me, again). This kind of small cap movement keeps me alive and my cortisol high, very important for one’s health (not wealth). Float/shares outstanding for each name is <50%, with the exception of Keystone. This means that the companies are very special and probably shouldn’t be public. All positions have benefitted over the year from FX which is a surprise. I’m essentially a better FOREX trader than I am investor this year. I underperformed the market, and underperformed my benchmark ($DHHF) by about -5%, give or take. Really should have kept that Little Book on Common Sense Investing that I gave my ex-girlfriend. Should have just read that and indexed.

Standouts: Nekkar’s share price has nearly halved (a sinking ship! Anyone?) and Zigexn has done okay. Oddly they are both the cheapest in the portfolio (~ 4.9 & 7.7 EV/EBITDA respectively) and the most cyclical (shipyard construction / ads business). Do NOT ask me why this is happening. I do not know. Energy One put on a bit of debt, but has the cash to cover interest. Others don’t really employ leverage, so things look healthy balance-sheet wise. On valuation, the portfolio looks fairly valued with the exception of Energy One which still looks optically expensive (but is growing at quite the pace).

Out with the old, in with the new

Sells

In short, I was booted out of $KPG due to a stop loss which I had set just below my cost basis. The stop-loss has worked against me, the price of $KPG stock recovered almost immediately after my stop loss went off. Finesse. You can imagine my frustration. I did this to try and protect myself when buying into an optically expensive stock. Netted out a nil gain / loss on Kelly Partners. Still managed to get a free book out of being a shareholder for… (checks notes) 8 months. Oh and 0.07% div return. Hell yeah. Let us not mention inflation. From a fundamental perspective though, the CEO is harping on about US expansion stuff, and hosting RWNJs on a sub-scale podcast. With many cheaper, smaller and equally impressive companies available - why would I buy back in at my cost basis? Not sure. Its on the watchlist if the rollup reckoning comes for $KPG but for the time being, I’m going to give it a miss.

I locked in OTRS losses when I realised I had fundamentally misunderstood the IT service sector and OTRS’ place in it. The quality of my DD was lower when doing my writeup (hard to believe it was worse than it is now). Also, their OPEX was too high for a company growing that slowly imo. It said to me that their competitors were more strongly positioned than I had anticipated. Also, reading their FY report was a pain and put me off (they seemed to be focussing on all the wrong things). Coupled with the availability of other opportunities, namely doubling down in Keystone, I sold. This locked in a -44% loss. The price has slightly recovered but still generally down, and the company is yet to report. I wont be following it.

Mobruk was a bonafide panic sell of the finest variety. One day I woke up and asked myself what the hell a ZLOTY really was and what it might do? For context, both Mobruk and Kelly Partners were positions I took based on the research done substantially by others and partly on my own. This established shaky ground as things were to begin with. The businesses had come up in my own screens for quality but what pushed me over the line was someone else’s conviction. Not good. Unfortunately the macro element rattled me a bit, along with the Polish currency woes. Add a war and a post on Value Investor’s Club about some (allegedly) dodgy things the Company was doing. You get me, Mr. Papierowe Ręce. Whether the claims on VIC were correct or not, or whether I understand developing economies or not (I don’t), it revealed to me that investing in developing markets and mafia trash disposal companies was not something I was particularly interested in doing. Especially when I felt valuations would soon drop in developed markets for companies I’d actually like to own. Hence, I locked in a -12% loss to free up capital for DSW.

Buys

In January I tried averaging into Energy One at around $5.85 - $6.15 per share over the month. Energy One ended up being a detractor (though not my worst), and I would have benefitted by setting a stop-loss at my cost basis but regrettably I did not do so. Of all the positions in my portfolio, Energy One concerns me the most on valuation. It remains the most expensive ‘growthy’ business I own. It is also growing EPS at a crazy ~50% 5Y CAGR. So, YOLO. It is important to risk it for the biscuit. Unlike OTRS which I selected at an okay price but with a poor understanding of the company’s competition, I actually think Energy One has an excellent competitive position but I got a bit overzealous with the valuation.

Buying Zigexn in April has proven to be the most successful purchase of the year. Advantageous FX rates put this business back on my radar and it seems I almost bottom-ticked the JPYAUD by accident. It remains the best performing company in the portfolio all year, and still the cheapest! ジョーが大好き ^_^

Ironically, I decided to take the capital from OTRS and put it into Keystone, which has been a more efficient way of lighting the cash on fire in a manner faster than had I left it in OTRS. Talent. Finesse. Style. I’ve got it all. Anyway, I’m much more confident in the long run prospects of Keystone, plus I’m a lawyer with a bit of insight into the sector, and I think Keystone is onto something special. I hope that this proves to be a wise decision. I bought some Keystone in August at 5.98GBP/s. I doubled my position this month at 4.30GBP/s. Keystone released positive results which added to conviction and of course the valuation is getting more reasonable.

My final new purchase of the year was DSW Capital in two chunks, around $1.15GBP/s in August and then again in October. So far the position is up, ever so slightly but it's very volatile. DSW released some positive results. The stock is absurdly quiet and illiquid.

What's on my to-research pile?

$8416 (Solidwizard) is a bit of a laugh if I’m being honest, it is impossible to DD it properly. I’d have a better time trying to analyse one of my own Solidwizards that I drop off each morning. But some incredible numbers, if they’re real and I don’t get drafted into WWIII with the Chinese. $KARO I’m waiting for more things to come out in the wash as a recent IPO, but I’d like to get across it. Telematics could be fun to research. Lots of public comps. $4832 is a classic cheap as chips Japanese spinoff with governance question marks. Appears $SMLR might be an unloved dog, same with $UG. Would need to look at why these have been punished.

I also have a few companies on a list for carnage in housing in NA/Canada, if it happens. $ITIC, $VCI, $SOM being some examples that might get hit in the next down-cycle and ones I’ve had my eye on for a while. I’m also thinking a bit about big brands; larger companies like $GAW, $ALPDX, $OLPX and hell, even $GOOG to be honest. They’re starting to look cheap, probably on recession fears and being ‘discretionary’ (not all are the equal tho) spends. That might be an opportunity to get some cheap IP? Lets wait and see…

Honestly there are heaps of ideas out there, maybe even too many, and who knows how many of them are actually decent. One thing is for sure, I’ve been burned in the market over the last couple of months and have been busy with a new job! And the longer I’ve waited, the cheaper things have become. So I’m in no hurry. But I’m always keen to be writing one piece of DD at any given time, to build experience and hopefully some knowledge across similar sectors.

Substack

Lastly - congrats, you’re still part of a (very) niche crowd.

Thanks for hitting subscribe and giving all your feedback/comments and DMs etc. Send me your watchlist items! Keen to show you how much $ I’m lighting on fire in 2023 and the sophisticated way in which I do it. Until then, have a great Christmas and New Year. Stay messy and don’t take things too seriously. Don’t forget to pat the cryptobros on the back at the Christmas parties you attend - but do not feel sorry for them.

Anyway, heres Wonderwall.. I mean… Here is a possible poem about value investing written by Warren Buffett in Shakespearean style from ChatGPT:

To value invest, or not to value invest, That is the question:

whether 'tis nobler in the mind

To suffer the slings and arrows of outrageous fortune,

Or to take arms against a sea of troubles

And, by opposing, end them?

To invest: To hold, to wait, to trust in time's slow march,

And, by opposing, end them.

To hold: To wait, to trust, and by opposing, to grow.

Perchance to thrive: ay, there's the rub,

For in the holding, waiting, trusting,

What profits may come, when we have shuffled off

This mortal coil, must give us pause:

There's the respect that makes calamity of so long life.